excise tax division nc

The state of north carolina charges an excise tax on home sales of 200 per 100000 of the sales price. For example a 600 transfer tax would be imposed on the sale of a 300000 home.

Internal Revenue Code 4121.

. Use Form Gas-1274 to request a Motor Carrier Application for License and Decals from the North Carolina Department of Revenue Excise Tax Division. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. INTERNATIONAL FUEL TAX AGREEMENT.

Transfer taxes in North Carolina are typically paid by the seller. PO Box 25000 Raleigh NC 27640-0640. There are also federal excise taxes on cigarette rolling paper and cigarette tubes.

Any payment must be drawn on a US. 3301 Terminal Drive. 1 2020 Information Who Must Apply Cig License.

Vehicles are also subject to property taxes which the NC. North Carolina or The Tar Heel State is located in the Southeastern United States and is currently home to roughly 10 million people. If Balance Due - Mail the return and a check for the balance due to the North Carolina Department of Revenue Excise Tax Division P.

Federal excise tax rates on various motor fuel products are as follows. 105-22830 provides that the excise stamp tax on conveyances is computed on the consideration or value of the interest or property conveyed exclusive of the value of any lien or encumbrance remaining thereon at the time of sale The deed in question recites that as a portion of the consideration of the. Excise Tax on Conveyances.

2478 per pound or 15488 per one-ounce tin. 05033 per pound or 00315 per one-ounce tin. 151 per pound or 00944 per one-ounce tin.

North Carolina E cig excise tax. The controlling statute GS. Excise Tax Division 1429 Rock Quarry Road Suite 105 Raleigh NC 27610 Telephone.

IFTA License Decals. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. Seven counties in North Carolina are authorized to impose an.

Ad AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. An Affidavit may be required with any instrument conveying real property including leases and memorandum of leases. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Form Gas-1274 by contacting the Excise Tax Division hereafter referenced as Division ofice located in Raleigh at 919 733-3409 or 877 308-9092 or. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. North Carolina Department of Revenue.

File with Currituck County Tax Department. Domestic bank and payable in US. Tax CollectorTax Administrator Phone.

Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina. The price of all motor fuel sold in North Carolina also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. 1-877-308-9092 2018 MOTOR CARRIER SEMINARS SPONSORED BY THE EXCISE TAX DIVISION REGISTRATION FORM No registration fee required In an effort to better serve you the North Carolina Department of Revenue is sponsoring a series of Motor.

NEW 5 CENTS PER MILLILITER ML ON CONSUMABLE VAPOR PRODUCTS EFFECTIVE JUNE 1 2015 This in respect to our wonderful politicians who believe in freedom choking and. 8772523052 corporate and franchise tax sales and use tax registration other taxes excise tax division. Individual income tax refund inquiries.

Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. 135 E Water Street PO Box 1027 Statesville NC 28687.

Excise Tax on Coal. Small business self employed specialty division. Box 25000 Raleigh NC 27640-0950.

The Excise Tax Division of the North Carolina Department of Revenue is moving from our current address located on Rock Quarry Road in Raleigh North Carolina to the following address. This Article applies to every person conveying an interest in real estate located in North Carolina other than a governmental unit or an instrumentality of a governmental unit. If return is on time but underpaid 10 of tax due or 50 whichever is greater is due.

NORTH CAROLINA DEPARTMENT OF REVENUE EXCISE TAX DIVISION INTERNATIONAL FUEL TAX AGREEMENT COMPLIANCE MANUAL October 2012. North Carolina does not charge for your IFTA application or your decals. Back to North Carolina Sales Tax Handbook Top.

North Carolina Department of Revenue Excise Tax Division. Simplify compliance with automation software designed to work together seamlessly. If you have questions about the information in this notice please contact the Excise Tax Division at telephone number 919 707-7500 or toll free at 877 308-9092.

To receive your North Carolina IFTA license you must submit an application to the Excise Tax Division. Tax Administration Land Records. The excise tax is deposited in the black lung disability trust fund.

North Carolina Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0001 wwwncdorgov. EXCISE TAX ON CONVEYANCE OF REAL PROPERTY CURRITUCK COUNTY TAX DEPARTMENT PO BOX 9 CURRITUCK NC 27929 Complete each section and sign in duplicate with original signature.

Nc Affidavit Of Consideration Or Value Excise Tax On Conveyance Of Real Property Fill And Sign Printable Template Online Us Legal Forms

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

Fillable Online Dor State Nc Nc Department Of Revenue Excise Tax Division Address In Raleigh On Rock Quarry Rd Form Fax Email Print Pdffiller

3 11 23 Excise Tax Returns Internal Revenue Service

Simulated Revenue Growth From Cigarette Excise Tax Increases In Kenya Download Scientific Diagram

3 11 23 Excise Tax Returns Internal Revenue Service

Total Tax A Suggested Method For Calculating Alcohol Beverage Taxes Apis Alcohol Policy Information System

3 11 23 Excise Tax Returns Internal Revenue Service

3 11 23 Excise Tax Returns Internal Revenue Service

3 11 23 Excise Tax Returns Internal Revenue Service

3 11 23 Excise Tax Returns Internal Revenue Service

3 11 23 Excise Tax Returns Internal Revenue Service

North Carolina Alcohol Taxes Liquor Wine And Beer Taxes For 2022

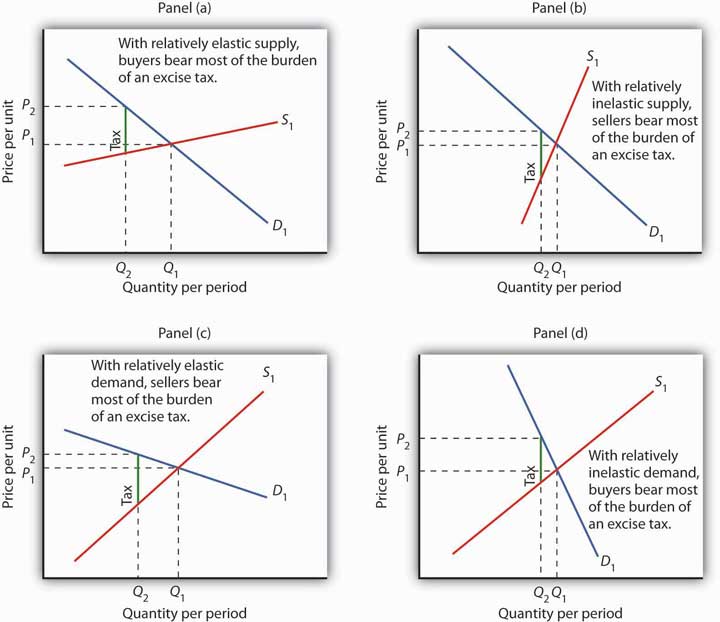

Reading Types Of Taxes Macroeconomics Deprecated

Ifta Newsletter 2011 March State Publications I North Carolina Digital Collections

Manufacturer S Suggested Retail Price Document For 1971 Opel Gt 3600 Opel General Motors Corporation Old Cars